How does Sprinque work?

Merchant Onboarding: Step One

Merchant onboarding marks the first phase as businesses join Sprinque to offer flexible payment terms to their buyers and enhance their cash flow management. After the contractual agreement is signed, the merchant onboarding journey begins, incorporating a Know Your Customer (KYC) procedure where merchants provide essential business documents for verification by Sprinque.

Merchants can choose to start fully manually before making the decision to integrate through the range of integration options like APIs, Sprinque SDK, Partner SDK, Plugins - WooCommerce, Magento, PrestaShop, and Shopware or even a simple Mailbox forwarding, for seamless access to our automated services. Merchant Onboarding is a one-time activity.

To know more about the detailed process of merchant onboarding, read more here.

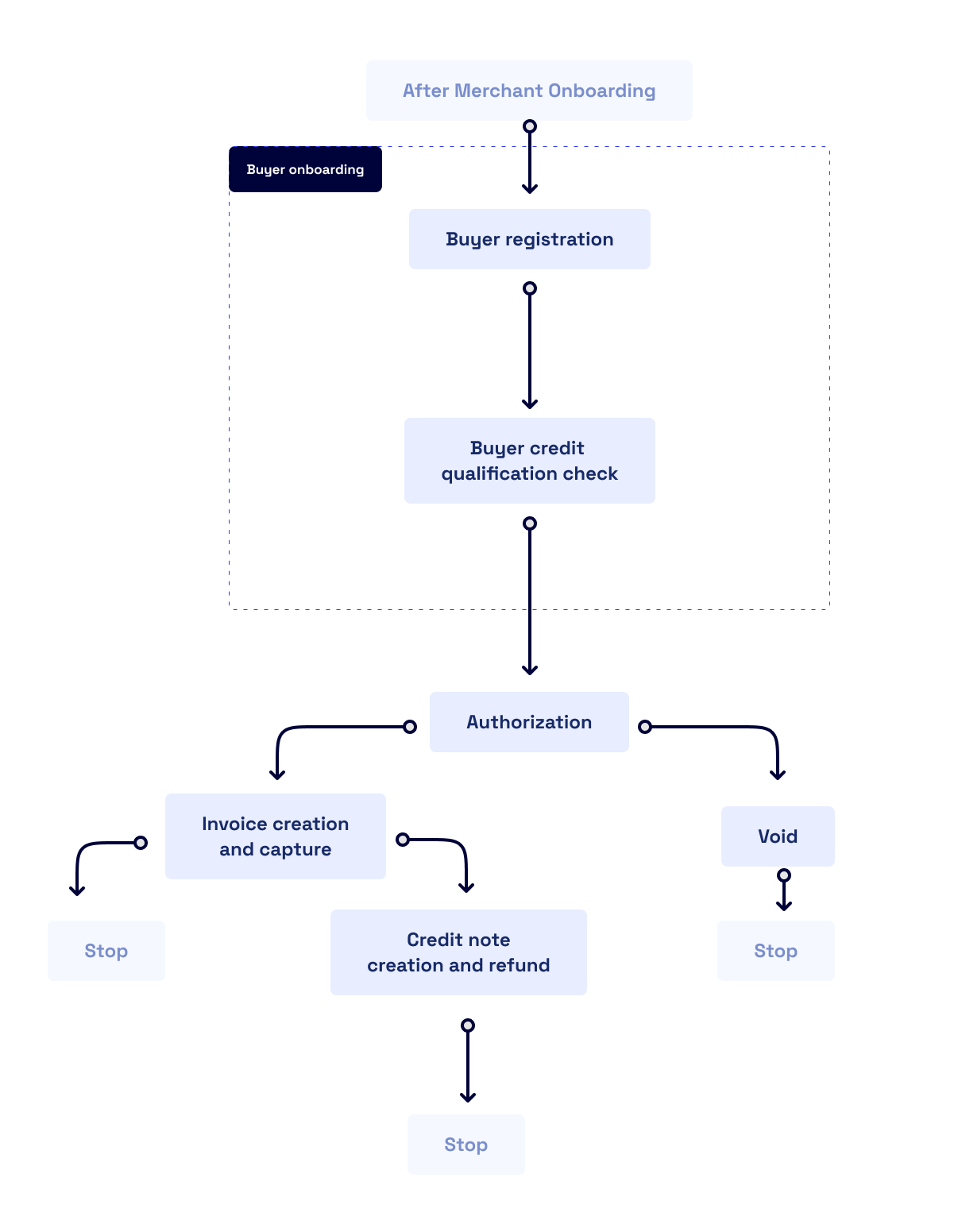

After a successful merchant onboarding, the subsequent step is the buyer onboarding.

Buyer Onboarding: Step Two

Merchants proceed by sharing data, such as business registration numbers, VAT numbers, company names, and more, regarding their new or existing buyers for onboarding them onto the Sprinque Merchant Control Center (MCC). For efficiency, Sprinque even offers the option of conducting a one-time onboarding activity to migrate existing buyers.

Using an internal credit decisioning model, Sprinque verifies the shared buyer data and evaluates the potential risks associated with the buyer. Based on this risk assessment, Sprinque assigns a unique credit limit and payment terms to the buyer.

Transaction Processing: Step Three

Once the buyer has decided to proceed with an order from the merchant, the transaction details are shared with Sprinque through an Authorization request. If the buyer's available credit limit is sufficient, they can proceed to make payment for the order, based on the assigned net term. In cases of insufficient credit limit, the buyer's payment request through Sprinque will be declined, allowing the merchant to work with Sprinque to potentially increase the buyer's credit limit.

Invoice generation can occur immediately or up to several months after the order, depending on the specific business needs and industry. Once the invoice is shared with Sprinque, the merchant receives a settlement based on the agreed-upon frequency, such as T+1, T+2, or T+7.

The responsibility for further collection of the invoice amount falls on Sprinque, which sends regular reminders to buyers. Buyers can conveniently repay their outstanding invoices using the Sprinque Pay Page.

In cases of buyer dissatisfaction with the goods, they have the option to request a refund from the merchant. Merchants can issue credit notes for the relevant amount through Sprinque. Sprinque supports various types of credit notes, full or partial, before or after the buyer has paid their invoice.

Settlements: Step Four

Settlement is when Sprinque pays out to the merchants for the invoices and credit notes, shared with us, at an agreed frequency. When the contract is signed between Sprinque and the merchants, the default settlement frequency and pricing are agreed upon.

Merchants have the flexibility to select when they want to get paid per invoice. This can easily be shared with Sprinque while sharing the invoice with us or at anytime later from the MCC.

Merchants can also decide how much they get paid, ie, they can either take the Sprinque fee on themselves or choose to pass it on to their buyers. Sprinque even allows you to share the costs across merchants and buyers. Well, what can I say, we are really flexible!

Note - All payouts to be made on Saturday and Sunday will be paid out on the Monday following them.

To know more about the detailed process of merchant onboarding, read more here.

Payment Collections: Step Five

Once the invoice has been shared with Sprinque, Sprinque is responsible for all the risk as well as payment collections. To be transparent and to ensure you have the Sprinque bank account in the invoice, we have APIs to expose the payment collection account.

The collection process starts with informing the buyer over email about the amount to be paid and by when. We also send regular reminders once the invoice is overdue.

We understand you would also be curious about your buyer behavior, hence, we developed a webhook to keep you informed if a buyer has paid the invoice or not. For more details on this webhook - check out our article here.

Updated 8 months ago